Registration Demo – How to Complete Our Online Annual Report

Transcript of video:

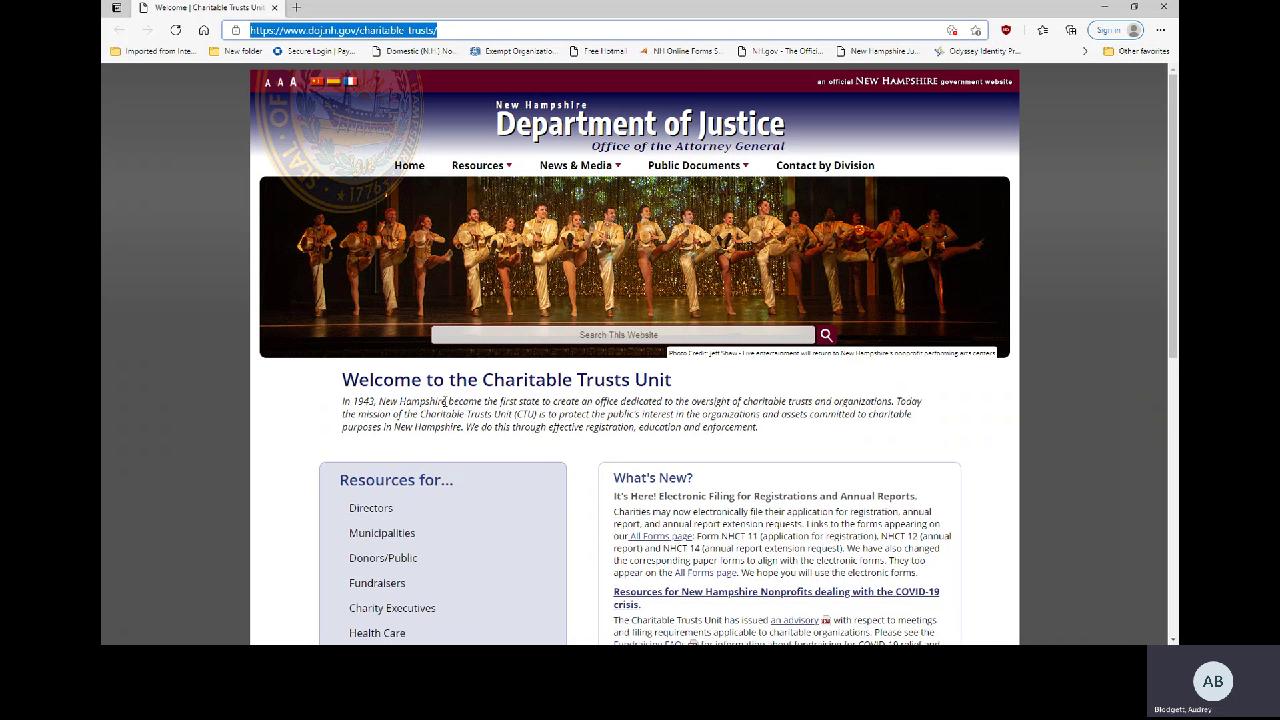

Hello, my name is Audrey Blodgett. I am a paralegal with the New Hampshire Attorney General's Charitable Trusts Unit and I'm excited to be here to share the new E forms we have on our website that are now available for online filing. Today's form is our updated report Form now known as the NHC T 12. You can get to that form from our web page. On our welcome page go down to our CTU forms and reports box. You can either click on the Annual report link here or click all forms to see all of our forms, any form available to be filed on line has this file on line logo. If you require an extension to file your report form that is also available online as the NHCT 14, so I'm going to click on the report form file on line. And as we get connected to the portal, you'll see we have some general instructions that include a link to the instructions for the report form, as well as a list of documents and information you should have available before beginning entry. I want to particularly point out this new authorization form. This form is for use by third party filers. We also have some frequently asked questions here on the right hand side and we have some contact information for the unit including our address, telephone number and email address. If you want you can click this print blank form here at the bottom which will create a PDF of the report form, which you can then review to make sure you have all the information you need before beginning entry. This is particularly helpful if you do not file a 990 with the IRS and are entering information line by line. We're gonna click on begin form entry. It's going to ask me to sign in. If you're not already registered as a user in our portal, you'll want to click this register link, Registration will ask for some basic information like name, telephone number, your email address, and ask you to create a password. I'm already registered. So I will enter my email address. And password. So I can start using the form and again we will click begin form entry. On the left hand side you can see that this form is divided into separate sections. You can jump from section to section, but if a required field indicated by this red asterisk isn't completed, you cannot submit your form. There may also be other sections or you will need to complete based on your answers to some of the questions in this first organization information section. Note up here it tells you the fee is going to be computed at payment. That's because you may have already paid the fee with an extension request. Or if you haven't paid that fee, it will be calculated to the $75 annual filing fee and on the right hand side you'll see this save progress button. Anytime you need to leave the form, you can click on this and the next time you go into the program, click on this History tab at the top. And you can open the saved form and continue on with your entry. So let's just fill in some information. I'm going to say that our fiscal year ends on December 30th. And I'm going to put in my registration number. The name of the charity. With our address. As you go along, if you hover over these little Is at the end of the fields, you'll notice that little help tips pop up. So that's helpful as you're going on if you sort of forget what it is that we're looking for. Has the organization changes name or address this year? If you click yes, we're going to assume that the address you typed above is your new address. If you change your name, a previous name field pops up an ask you for your previous name so we can cross reference your record. If the answer is no, no additional field pops up. Is a third party filer submitting this form. A third party filer is a business that handles charity filings all over the country. If you are a third party filer you'll be required to have your client complete the authorization form and then you upload it here. So I'm going to click. Yes, you have a link to the form if you haven't already had your client complete it. And then you have a upload window where you can click the choose file and go to wherever you store that and upload it into the form. If the answer is no, you're not going to see those fields. Ok, we want the name of the contact. Telephone number. And email. So that it will be easier to get a hold of anybody if we have any questions. Did the organization earlier submit s request to extend the deadline. If the answer is yes and your fee is already been paid, then at the end of the submittal process you will not be requested for the fee. If the answer is no, you will be requested for the fee. We know at this time we are accepting visa and master cards only. We hope to be able to accept Echecks later this spring or early summer. If you're a bank and a trustee of a testamentary trust sometimes payment is made with the probate account filing sometimes with the IRS filing. If the bank previously paid a fee for this year's filing, click yes here. Are you located in New Hampshire? Do you file a Form 990 PF? The answers to these questions control whether you see our pecuniary benefit form, which only New Hampshire organizations that are not private foundations, are required to file. I will answer yes to being a New Hampshire organization, and no to filing a PF you notice schedule C has appeared and we need to complete it when we get to it. Does your organization offer charitable gift annuities to New Hampshire citizens? If the answer is yes, another schedule, the Schedule D will show up here on the on the left hand side and it will need to be completed when you get to it. And if the answer is no, that schedule does not appear. Is your final report. In other words, you're dissolving or withdrawing from soliciting in New Hampshire. If the answer is yes, Schedule E shows up. That's our withdrawal report. If the answer is no, that does not show up, and I do want to point out these last two schedules are also posted on our website as standalone forms for independent completion. The next section, schedule A, is the financial part of your of your report. Enter your EIN number. And your IRS status. And if you file a 990, 990EZ or 990 PF with the IRS. You want to click yes. Please note that we do not accept the 990N for this. And in order to upload it, you just need to choose the file. And attach it and it'll tell you underneath the window that that file has been attached. If you're a New Hampshire organization, you may have other requirements to file for either a GAAP compliant financial statement or an audit, and you would file that here. If the answer to the original question, do you file a 990 with the IRS is no those two upload windows disappear? And we get several lines that you need to answer as you're going through it for. Notice that these total. Lines like this line 7. They're going to automatically total when you get these fields completed. These total lines will also appear if you're uploading in 990, but they can be ignored. Once you're done entering all your financial information. The next schedule Schedule B will require information regarding your board. If you are filing for an out of state organization, you can upload the page of the 990 document listing your board. New Hampshire organizations are required to file. More information and you have a choice. You can either upload an existing document that contains the information we request by checking by choosing file here and uploading your document, or you can complete a table by clicking this add row button. Complete the table for your first board member Add a Row to complete the table for your next board member member and continue on until you're done with your board. Depending on your answers to the, are you located in New Hampshire and do you file a Form 990 PF with the IRS? Questions you may be required to complete Schedule C. This requests information on your conflict of interest policy in any pecuniary benefit transactions over the year. Our last section. Unless you need to require, unless you need to complete the charitable gift annuity and final report schedules is our acknowledgement. Once this is completed. Click review. You can now review the entire document if any of the sections on the left hand side or read this indicates a required field has not been completed. It it looks like there's something missing from our organization Information section, so I'm going to click on that. Find the field. And it looks like my registration number is too long, so I'm going to correct that and go back to the review. No other red sections appear. Once you review is complete. Click on certify and submit. Once you review the certify and submit window, click submit form. If you answered no to the question, did you file an extension form? You will go to the payment page even though there's an option here to pay later. Please do not select that option if you do, we will not accept that filing, so click Pay on line. This will take you to the payment processor. Where you will enter your Visa or MasterCard information for the filing fee. After completing that and click on submit. The form is finished. If you did pay the fee previously you can just submit the form. You will receive an email with a link to your submission so you can check the status and review any notes to the file created by the CTU reviewer. You can also check your status through the History tab. This completes our demonstration of this new form. Once you're filing is submitted, it will be reviewed by CTU personnel. Any questions we have will be emailed to the filer. Once we have accepted the report, the status will be changed to issued. Feel free to contact the CTU if you have any questions.